CONTEXT

At Tala, we recently celebrated our fifth year anniversary in Kenya, and exceeded 1 million borrowers in both the Philippines and Mexico (see more on Tala 2019: Our Year in Review).

We’ve taken the first step to open up financial access, choice, and control for the emerging middle class. But we know that it takes more than credit to serve users’ needs across the dimensions of financial health.

PURPOSE

To this end, I was asked to create and lead a new product squad to continue validating new products that increase financial health & value for customers, while diversifying our revenue sustainably as a company.

Our goal was to validate a new, global product in one quarter, in order to build and launch in the upcoming year.

I worked with our CEO & leadership team to define the squad mission, definition of success, and team composition. And soon enough, we chose our team name: Apollo.

OVERVIEW

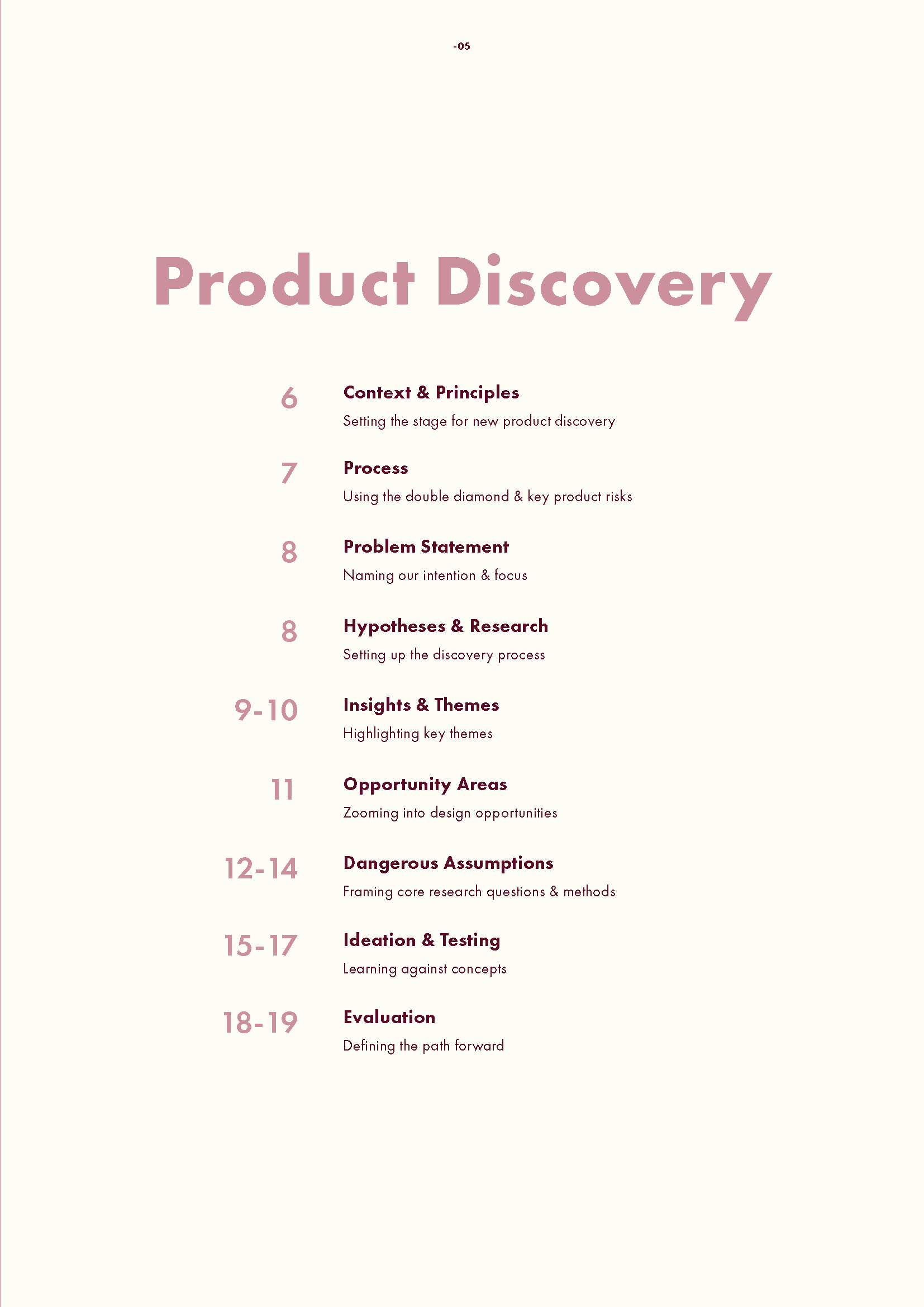

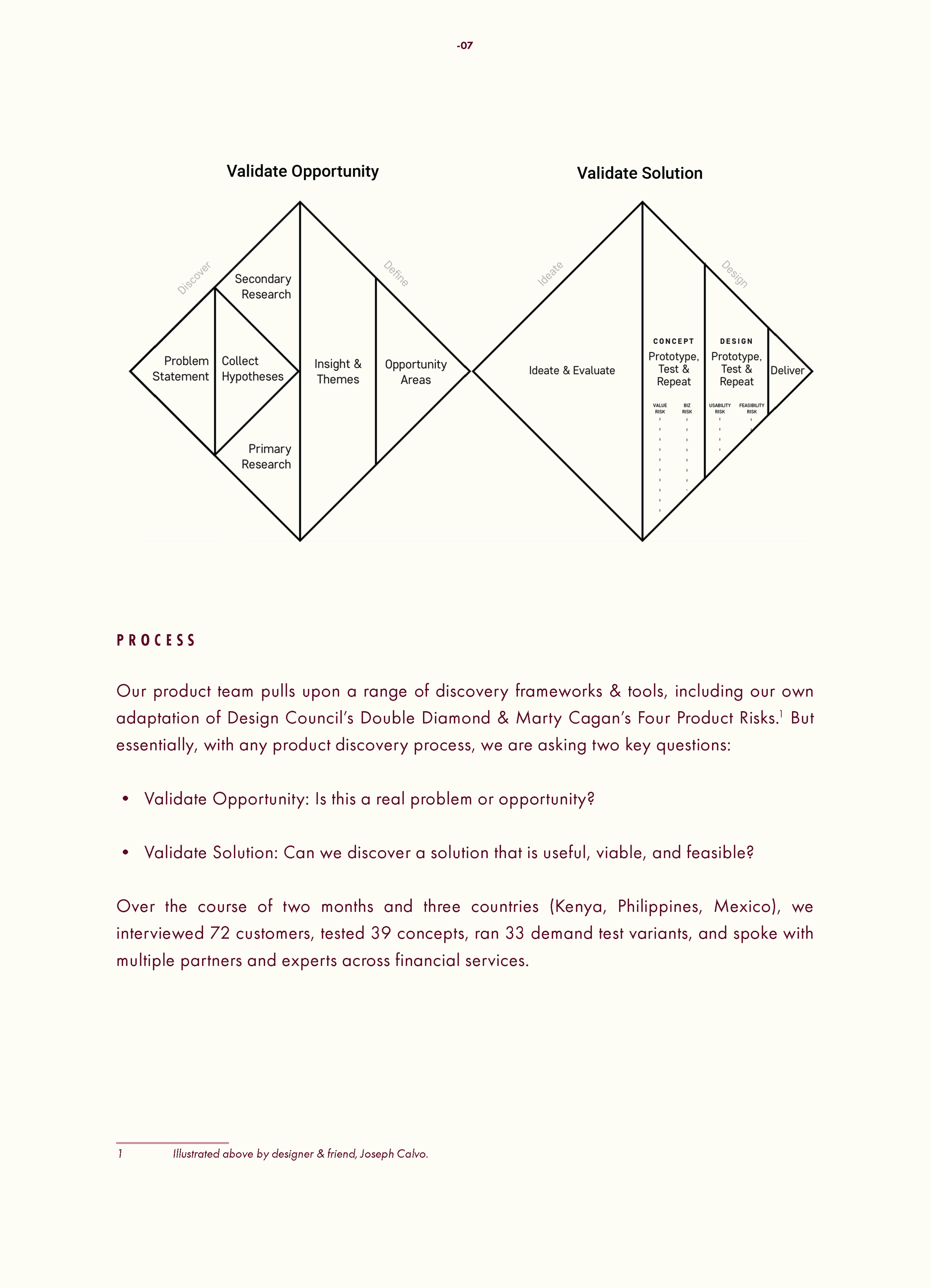

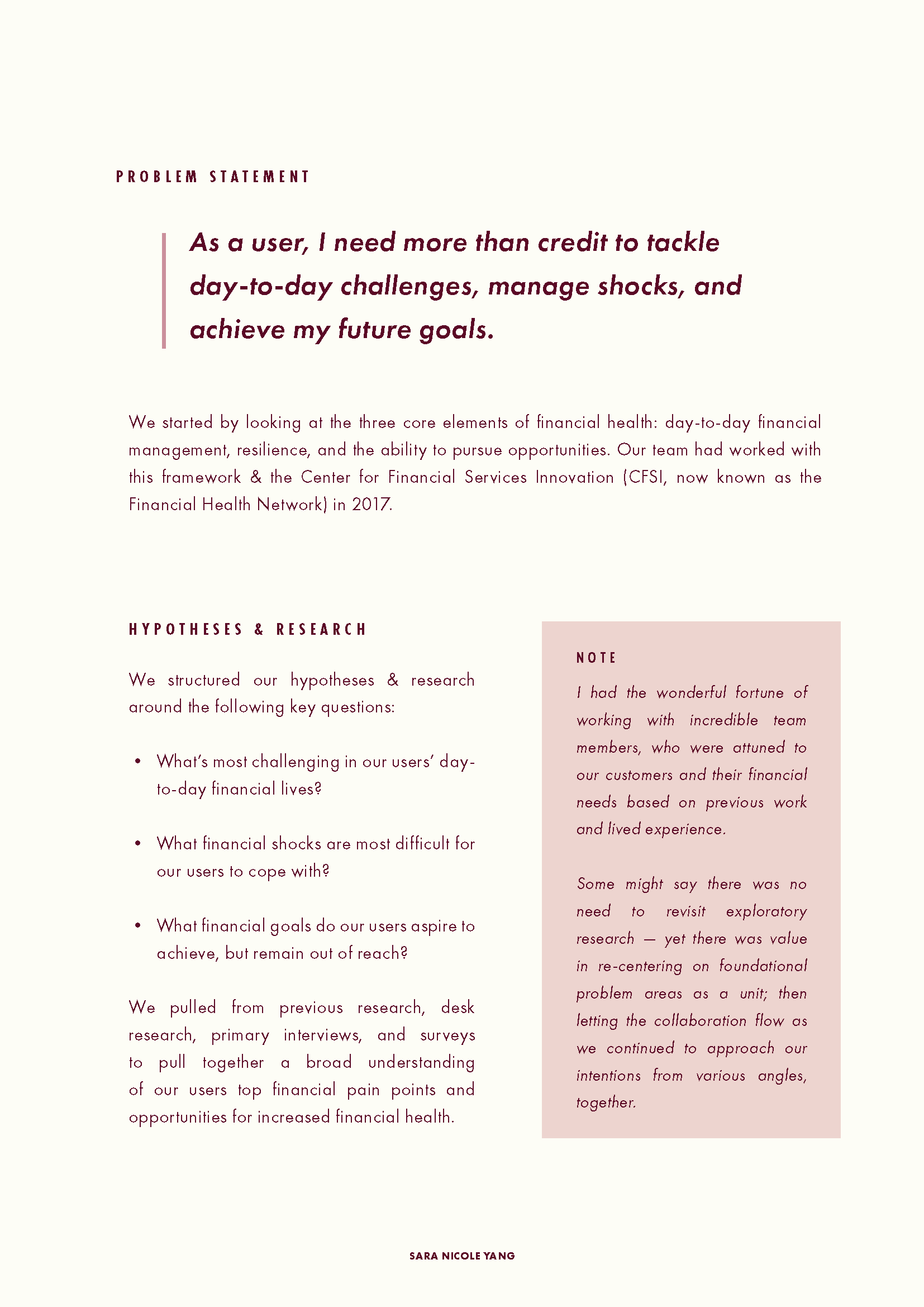

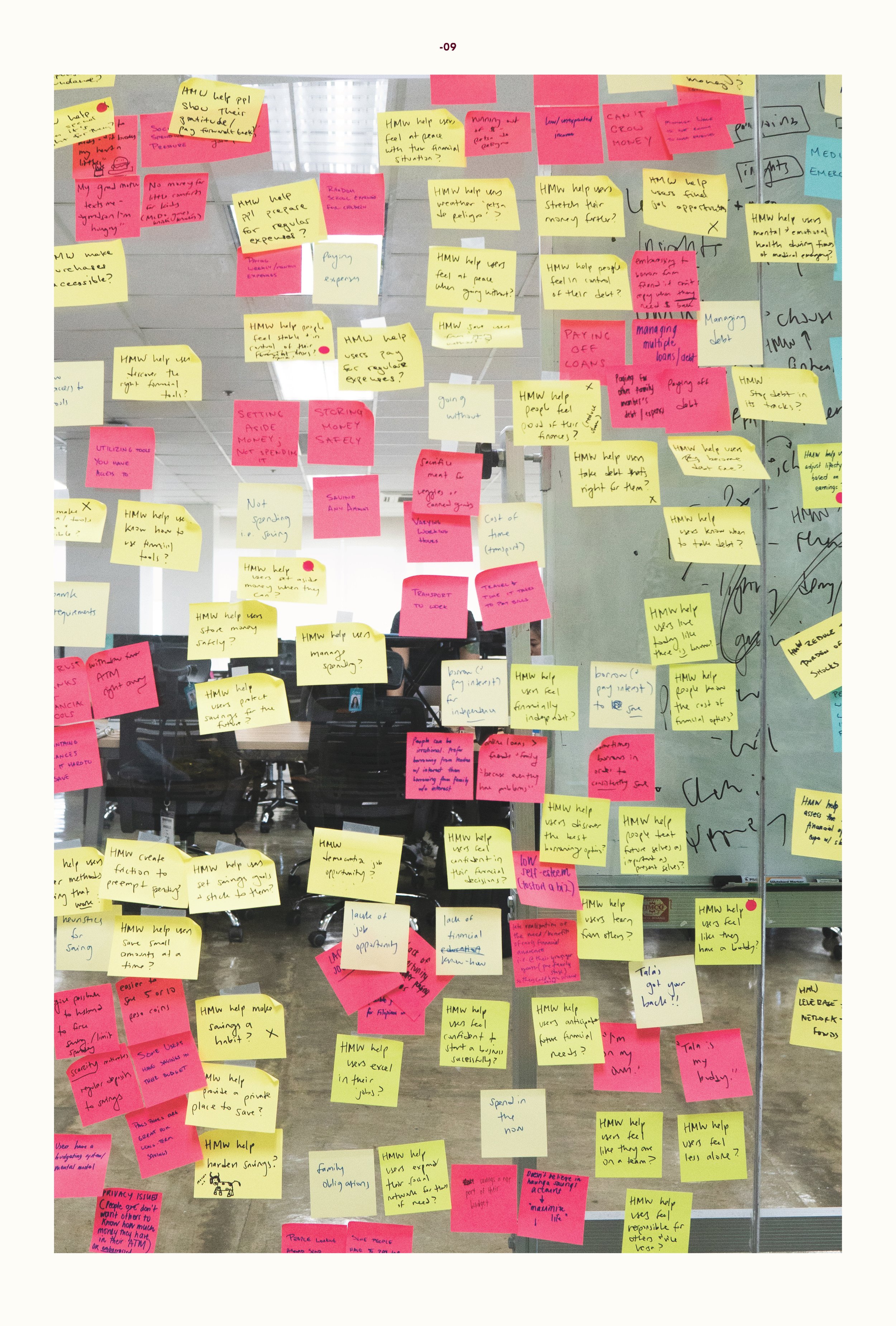

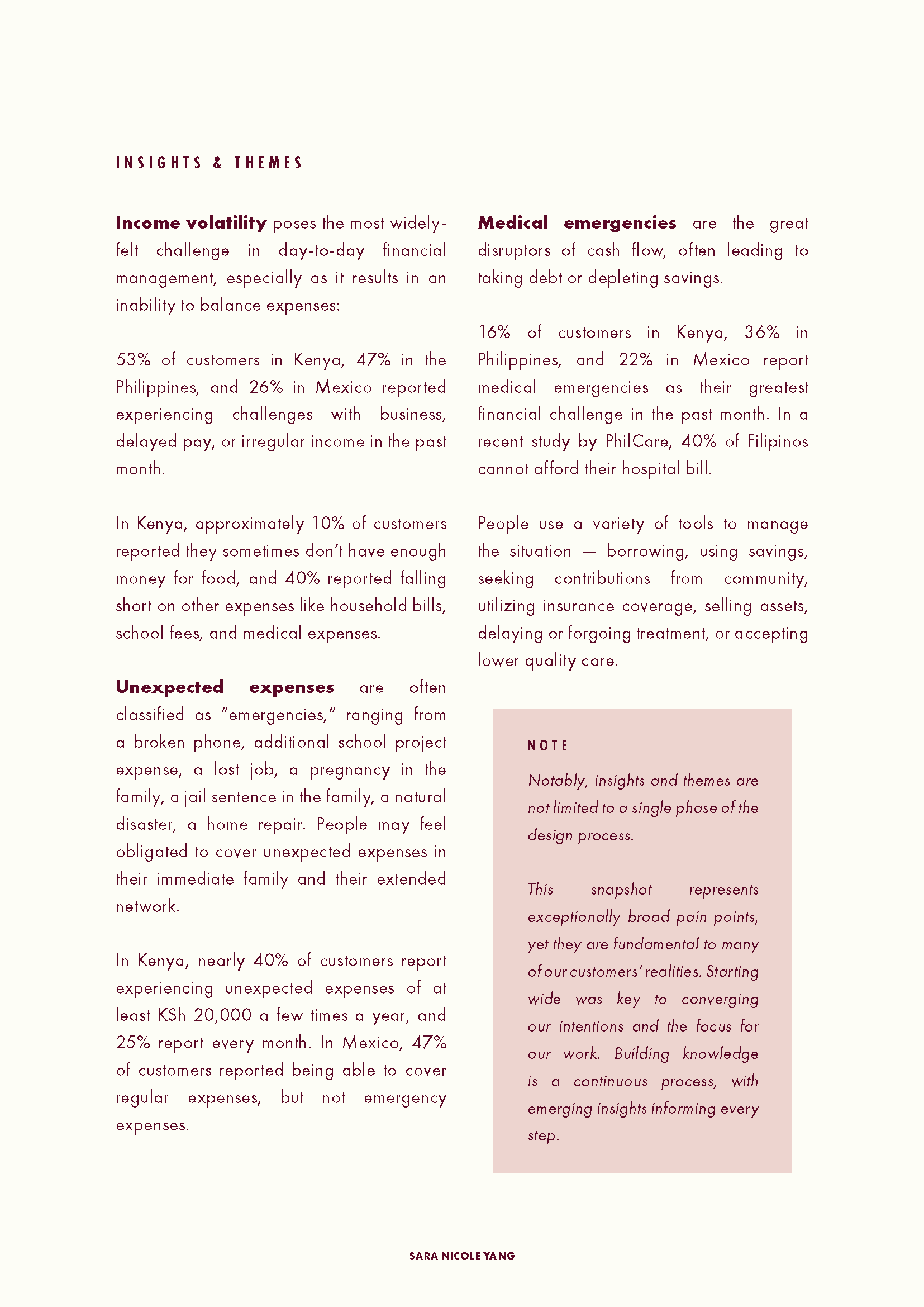

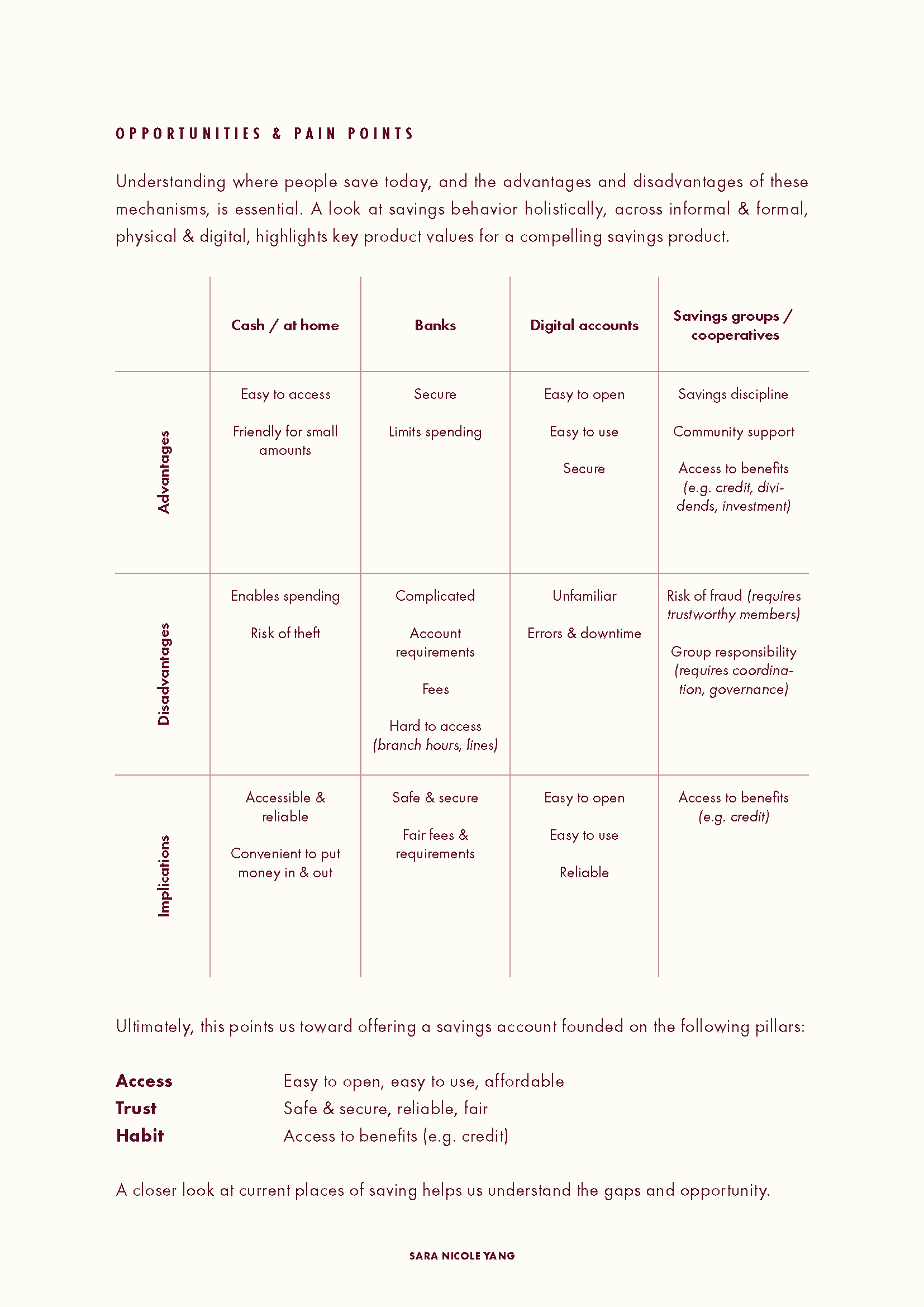

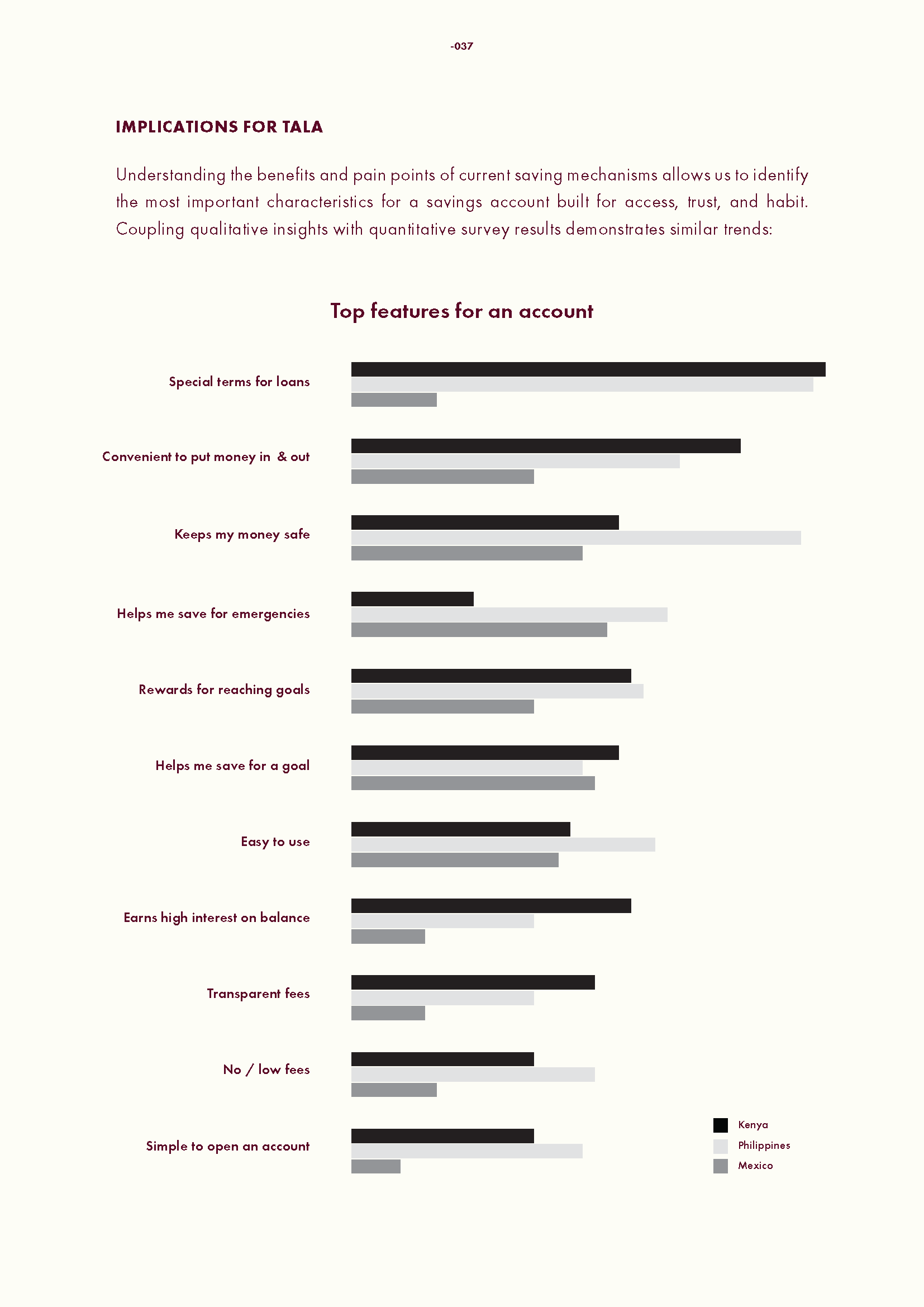

Over the course of two months, we interviewed 72 customers, tested 39 concepts, ran 33 demand test variants, and spoke with multiple partners & experts across financial services. We started by looking at the three core elements of financial health: day-to-day management, resilience, and the ability to pursue opportunities.

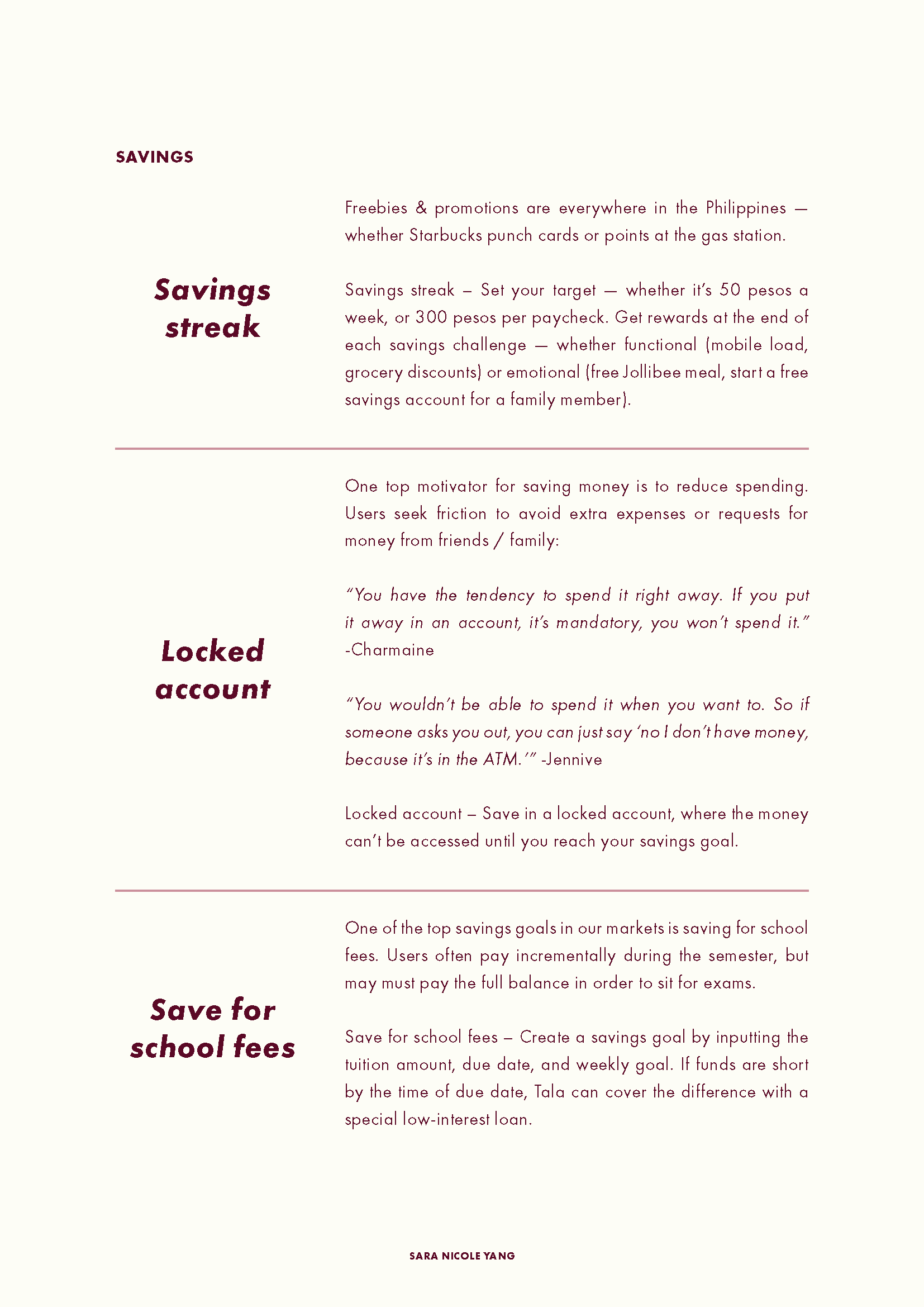

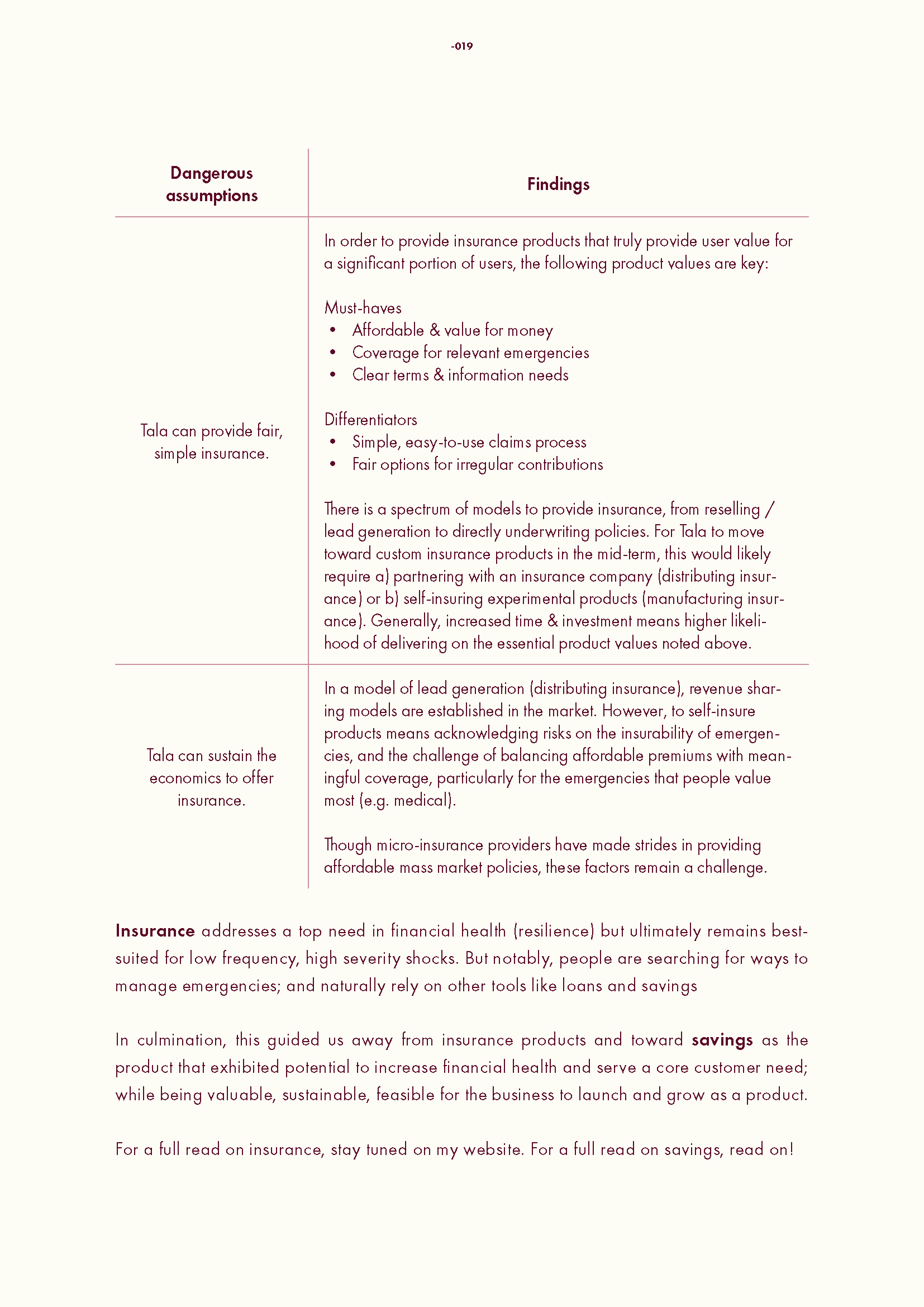

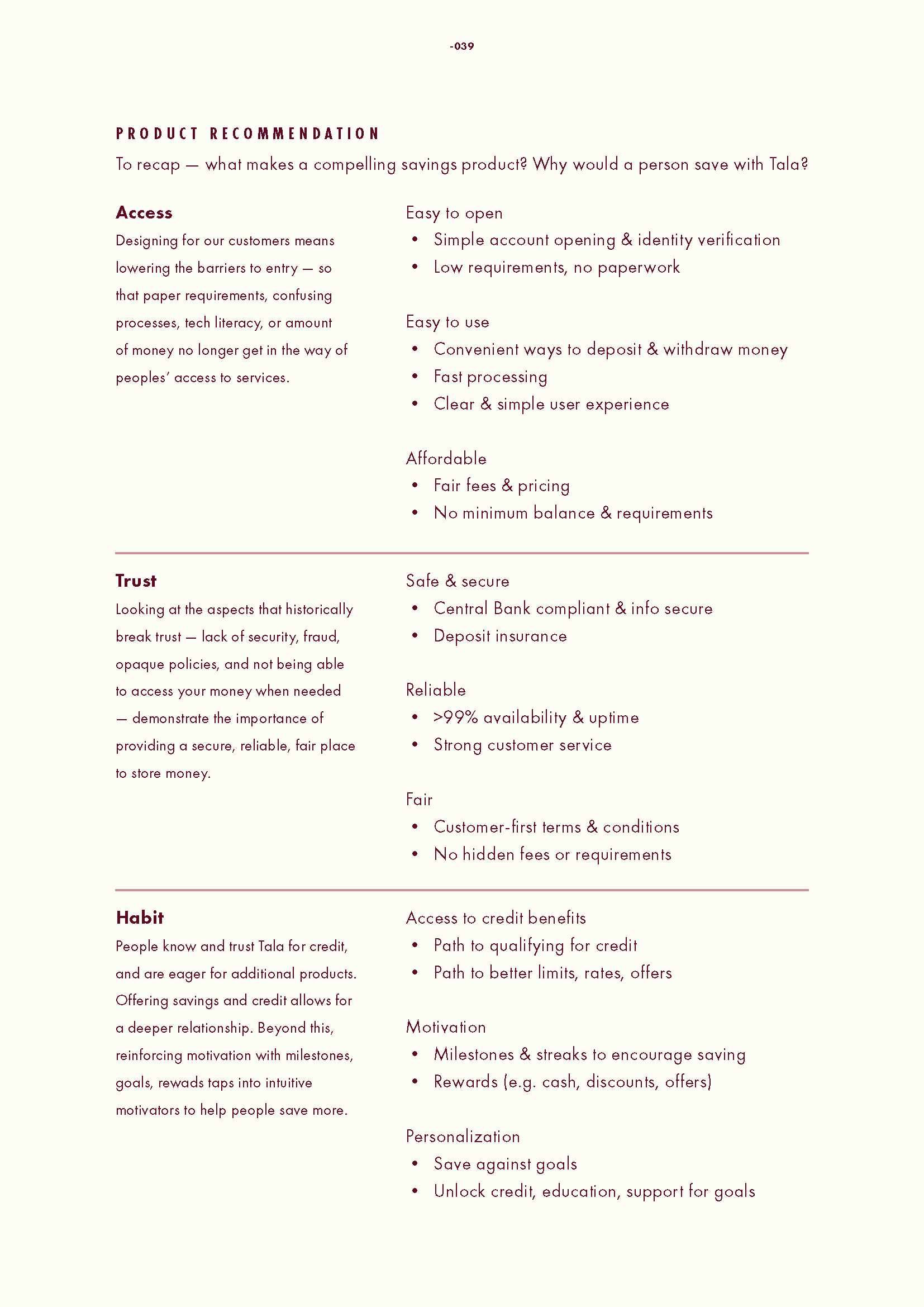

We traversed the design & research process and ultimately validated savings as a product that exhibited potential to increase financial health and serve a core customer need; while being valuable, sustainable, feasible for the business to launch and grow as a product.

I recently compiled our product discovery process & findings in the PDF below. Click through for the full read!